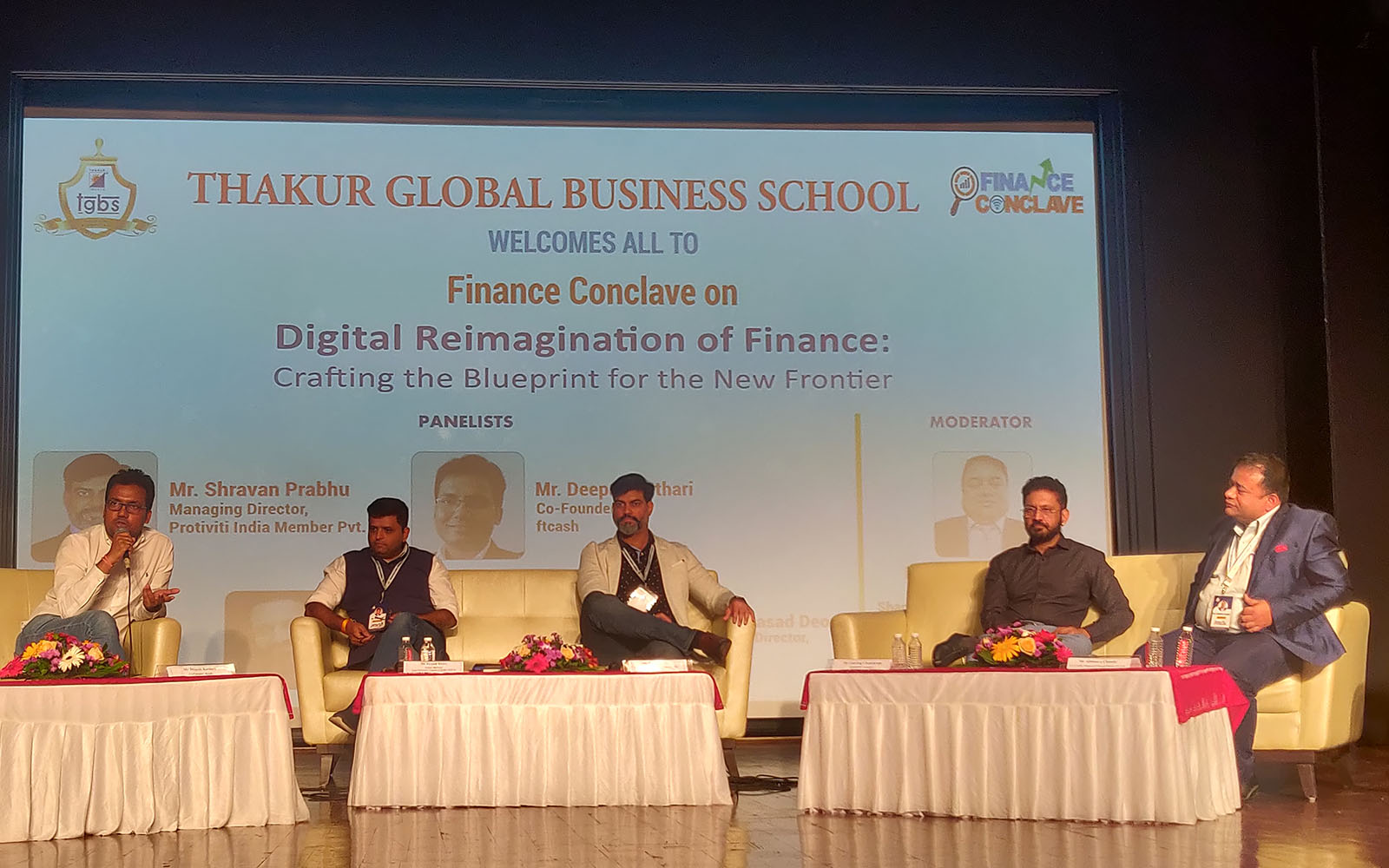

Thakur Global Business School organised Finance Conclave on 7th of October 2023. The theme of the Conclave was ‘Digital Reimagination of Finance: Crafting the Blueprint for the New Frontier’. The event received an overwhelming response with over 600+ eager participants from over 30+ colleges, alumni and working professionals across Mumbai. The event saw its inauguration with a Lamp Lighting ceremony. The conclave was declared open with a welcome speech by Dr. Nilesh Gokhale, Director TGBS, followed by an opening address by Ms. Greena Karani, CFO- Thakur Group of companies and TEG on “The Reality of Banking: Present and Past”. The keynote speakers effectively enlightened the students with their perspective on the conference theme. They spoke about the dramatic transformation that India underwent in recent years, driven by the rapid Digitalization of financial services. The talk further delved into the reality of banking today, its evolution over the years and the pivotal role of digitalization over the years. While the above topics were more so discussed by Mr. Saurabh Tomar (Head UPI & IMPS Product, NPCI), and Mr. Nishant Agarwal (Head Digital Business, Kotak securities) brought us into the world of digitalization not just in banking but the entire industry talking about the services rendered by Digi Locker, NEFT, online KYC and digital vaccination certificates during the time of COVID-19. Furthermore, next session of the event graciously greeted our 4 Prominent Panel Members namely Mr. Gaurang Chandrana who is currently an Independent Consultant and was formerly the Head of Operations at ESGRisk.ai, Mr. Shravan Prabhu who is the Managing Director at Technology Risk Protiviti India Member Pvt. Ltd., Mr. Prasad Deore who is the Senior Director at Data Security Council of India (DSCI) and Mr. Deepak Kothari who is the Co-Founder of ftcash while the Moderator of the event was, Mr. Abhinava Chanda who is the Vice President Credit at Shapoorji Pallonji Finance Pvt. Ltd. The Panel Discussion, however, delved into NBFCs who have acted as a response to slow changes in traditional financial institutions and their role in facilitating loans for small businesses, along with insights on tech risk frameworks, AI-driven risk assessment, and the importance of cyber security and data protection in the financial sector.